Explain the Different Types of Trade Credit

In this article we discuss the different types of credit Types Of Credit Trade credit bank credit revolving credit open credit installment credit mutual credit and service credit are some of the different types of credit. Revolving letter of credit 6.

But this usually not documented.

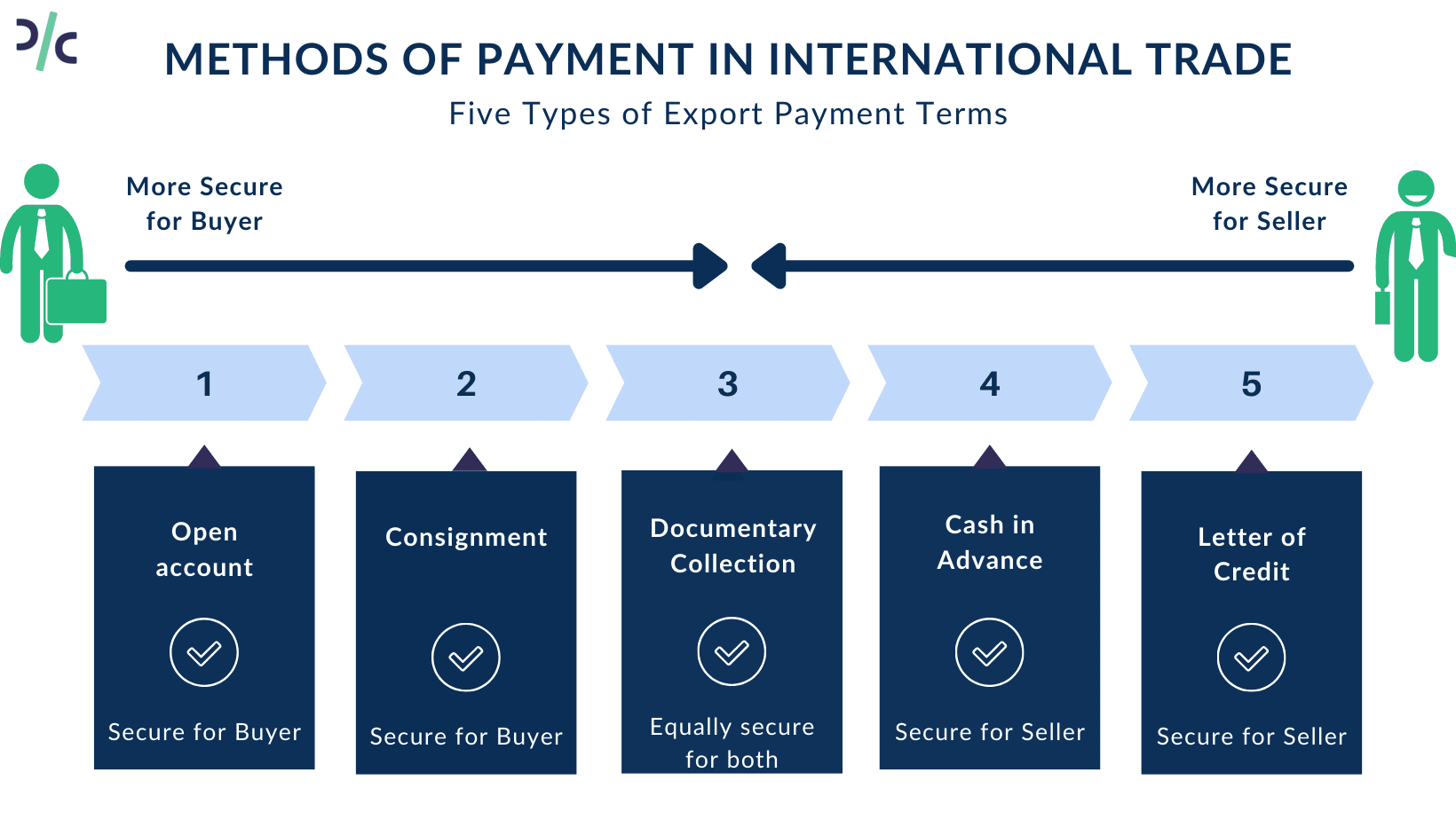

. Therefore the different types Letters of Credit are used to support these relationships. Consignment is another option that allows a. Revolving letter of credit.

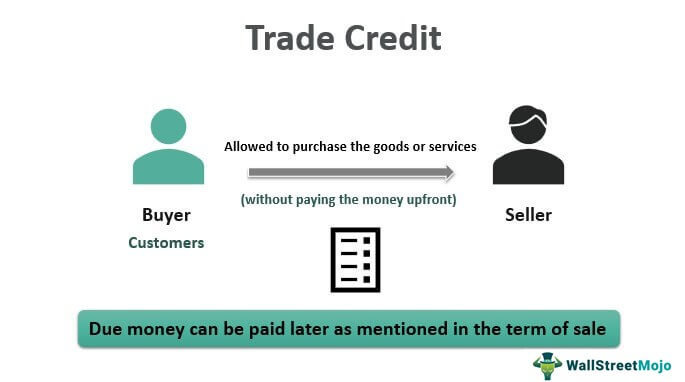

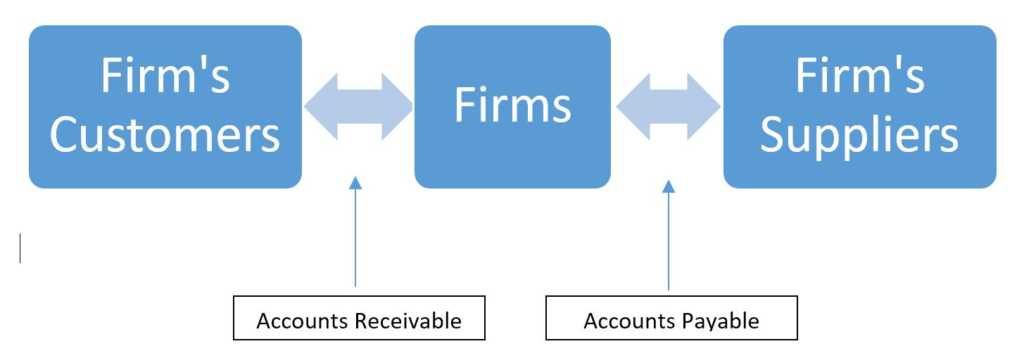

Trade credit is the loan extended by one trader to another when the goods and services are bought on credit. Thus they are able to make profits for themselves besides helping. The Approval Network believes in customer financial literacy and will work to explain the differences between different types of credit accounts.

In this system at the time of delivery of the products the seller is required to send an invoice showing quantum price total price and condition of sales if any purchaser buys the product on the account. Moreover cash advances or trade credits usually develop after both parties involved have developed a trusted relationship. Back-to-back letter of credit.

Payment-in-advance is a pre-export trade finance type which involves an advance payment or even. This is a standard letter of credit thats commonly used in international trade. Types of Documentary Credit 1.

Green clause letter of credit. Confirmed and Unconfirmed. Documentary letter of credit 2.

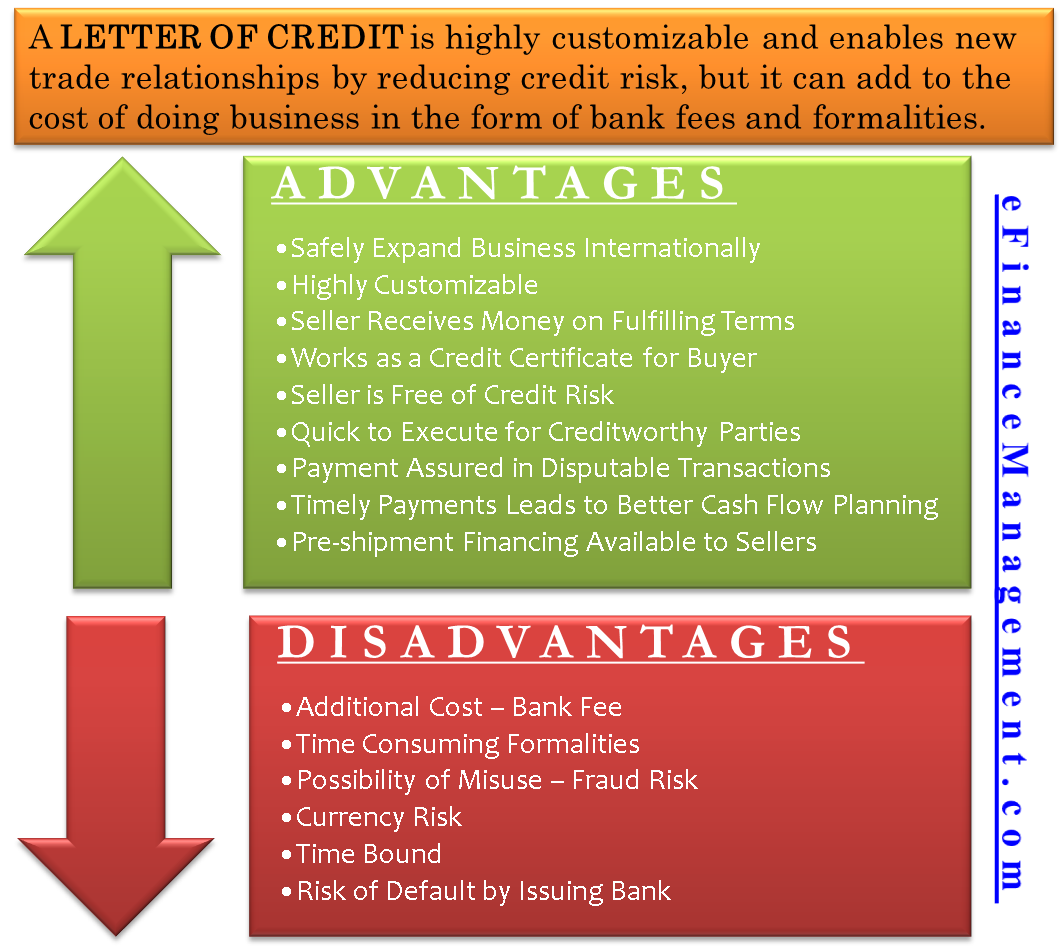

Different Types of Letters of Credit Commercial Letter of Credit. The principal advantages of a cash credit account to a borrower are that unlike the party borrowing on a fixed loan basis the borrower may operate the account within the. This is when the bank guarantees that the seller of the product will receive an agreed payment from the buyer.

It provides payment if something fails to happen. They are negotiated between the retailer and the supplier they are buying from. Standby Letter of Credit.

It is granted to those customers who have a reasonable amount of financial standing and. Irrevocable and Revocable The opening introduction referred to a written undertaking given by an issuing bank. Iv Credit enables banks to lend far beyond their cash reserves.

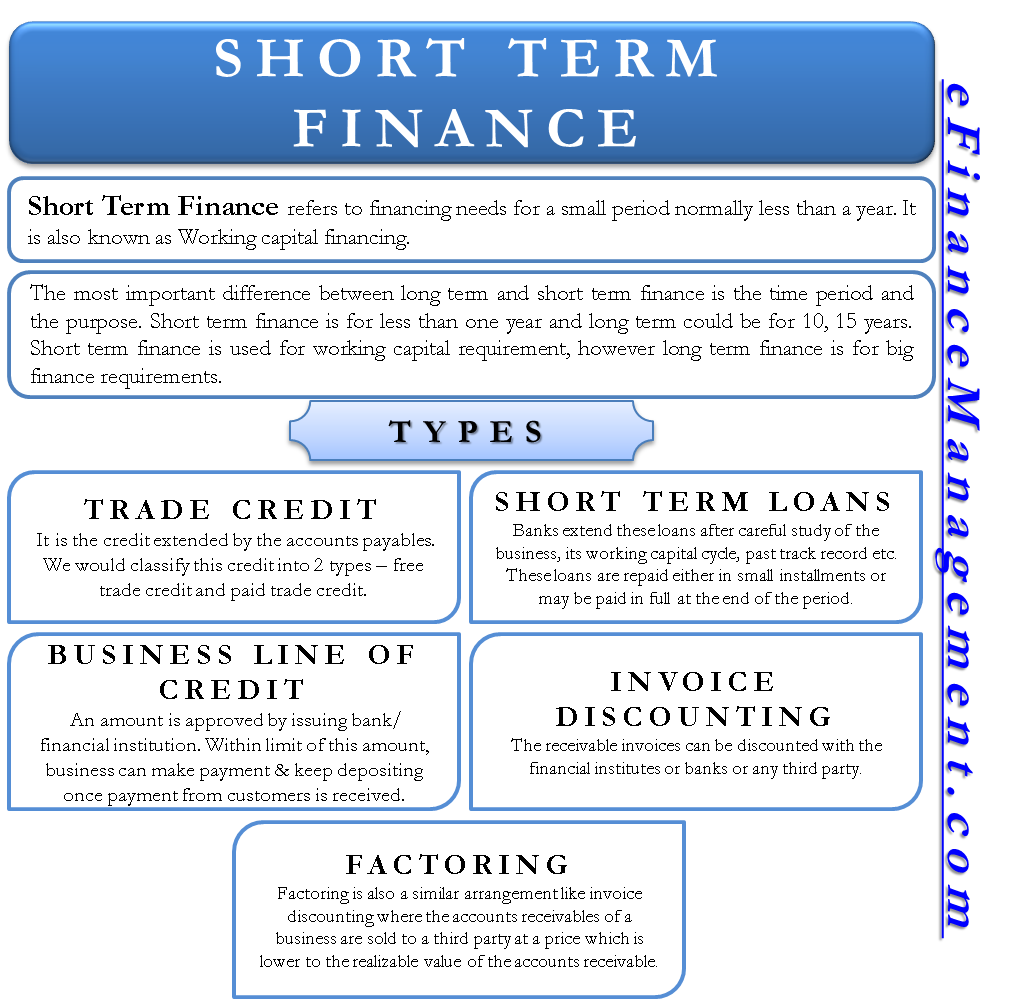

There are different types of credit meant for financing foreign trade which are through the method of pre-payment by working capital loans method of factoring by forfaiting and also through overdrafts or credit facilities. Such an undertaking is considered as irrevocable. In this post we are classifying them by their purpose.

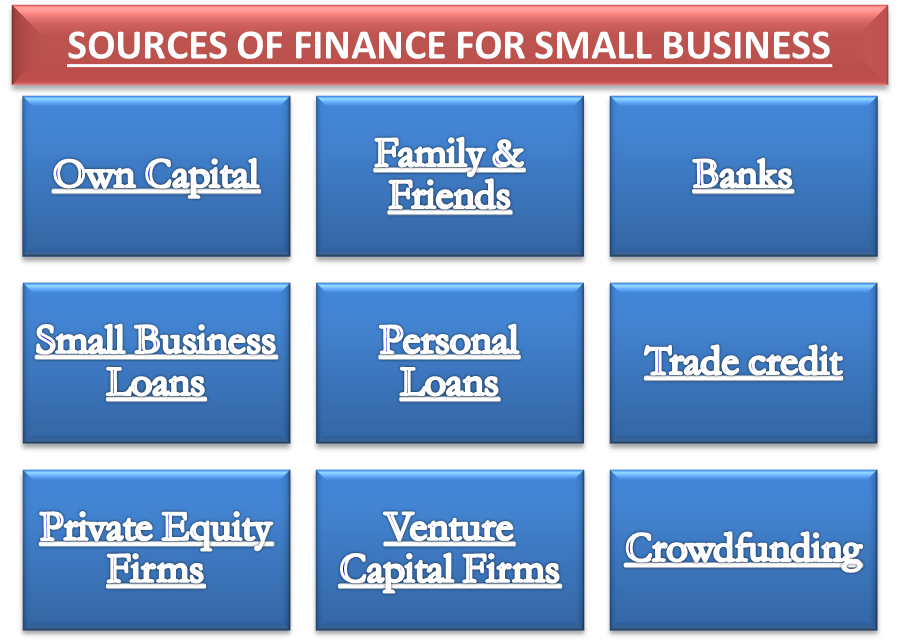

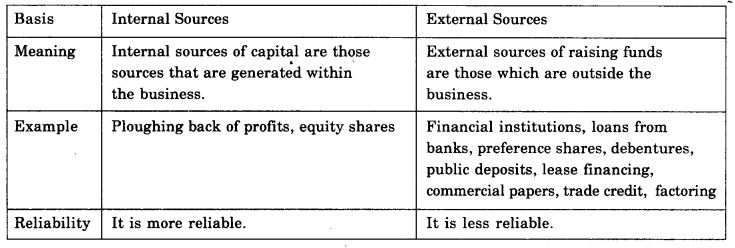

Without credit facilities a good deal of capital would have remained unused. CASH CREDIT A cash credit is basically a drawing account against credit granted by the bank and is operated in the same way as a current account in which an overdraft limit has been sanctioned. Trade credit is commonly used by business organizations as a source of short-term financing.

There are many types of trade credit terms. The most common contemporary letters of credit are commercial letters of credit standby letters of credit revocable letters of credit irrevocable letters of credit revolving letters. Let one of our expert credit analysts take the mystery out of your credit profile and get you behind the wheel of an affordable auto loan rate.

Sight letter of credit. In general international traders require financial intermediaries such as banks to guarantee payment and also the delivery of the goods. The amount you owe each month will vary depending on how much of.

There are various types of letter of credit LC that prevails in trade transactions. Trade credit facilitates the purchase of supplies without immediate payment. Documents Required in a Letter of Credit.

Clean letter of credit 4. Credit reports are complex and intimidating to the average reader. It is a way of reducing the payment risks associated with the movement of goods.

CREDIT TYPE 3. Red clause letter of credit. With open credit the amount due is usually different each billing cycle and that amount is typically due in full.

This type of finance is very commonly used for international trade. This type of letter of credit is different. Usance letter of credit.

Read more facilities and their typical usage in the course of the business. Expressed more fully it is a written undertaking by a bank issuing bank given to the seller beneficiary at. Some types of industries involving high ticket items which may have a longer selling cycle may extend trade credit up to 180 days.

The second type of payment that is available for Tescos is letters of credit. Revocable and irrevocable letter of credit 3. Here are some of the trade finance types 1.

Types of Letter of Credit 1. Working capital loans or business loans can be used to finance the up front cost of doing. Iii Credit makes capital more productive.

Confirmed letter of credit 7. With or Without recourse letter of credit 9. It may include regular minimum payments but usually there is not a fixed.

Types and Features of Letters of Credit. Types of trade credit. They are Commercial Export Import Transferable and Non-Transferable Revocable and Irrevocable Stand-by Confirmed and Unconfirmed Revolving Back to Back Red Clause Green Clause Sight Deferred Payment and.

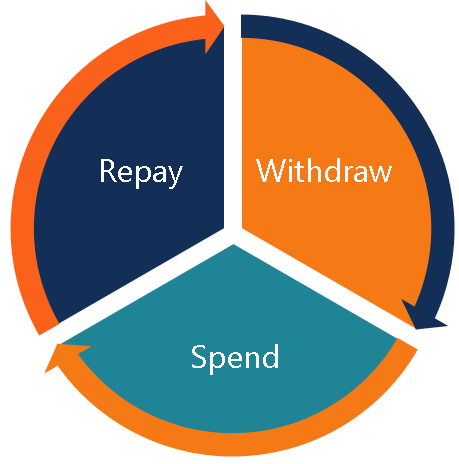

It is through credit that capital is transferred from persons who cannot use it themselves to persons who are in a position to do so. A line of credit Bank Line A bank line or a line of credit LOC is a kind of financing that is extended to an individual corporation or government entity by a bank or other is one type of credit that comes with a capped limit and can be used up until you reach the predetermined threshold. The common types of trade credit net10 net30 net60 and net 90 simply mean that the supplier is extending the due date of the payment for products delivered 10 30 60 or 90 days respectively.

Back to back letter of credit 8. A letter of credit is a bank undertaking of payment separate from the sales or other contracts on which it is based. Two Types of Credit Facilities.

This type of credit contains elements of both installment and revolving credit. Standby letter of credit. Regular letter of credit also known as a documentary letter of credit or a commercial letter of credit Confirmed letter of credit.

A utilities accountgas electric wateris a good example of open credit. The party in whose favour the credit is issued and normally the provider of the goods services or performance the seller or exporter. Most letters of credit are importexport letters of credit which as the name implies are letters of credit that are used in international tradeThe same.

Assignable and non-assignable letter of credit 5.

Types Of Credit Definitions Examples Questions

Trade Credit Advantages And Disadvantages Financial Management Credits Trading

Infographics What Is A Standby Lc Sblc Providers Trade Finance Finance Bank Finance

Export Payment Terms Cad Dp Da Lc Oa Advance Payments Drip Capital

:max_bytes(150000):strip_icc()/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types Examples

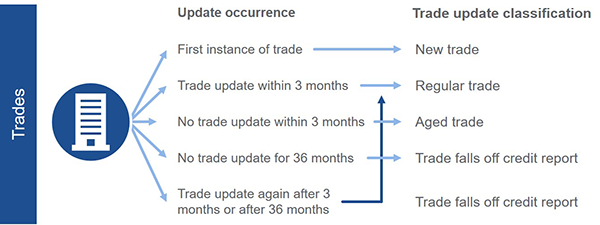

Adding Tradelines To Build Credit For Your Business Small Business Matters

Short Term Finance Types Sources Vs Long Term Efinancemanagement

Sources Of Finance For A Small Business Efinancemanagement Com

Trade Credit Definition Examples How Does It Work

Cbse Class 11 Sources Of Finance Trade Credit Offered By Unacademy

What Is Trade Credit The Way Trade Credits Work Examples

Various Types Of Trade Credit Trading Financial Management Types Of Entrepreneurship

2 10 Net 30 Understand How Trade Credits Work In Business

What Is Trade Credit The Way Trade Credits Work Examples

Advantages And Disadvantages Of Letter Of Credit Efm

Ncert Solutions For Class 11 Business Studies Sources Of Business Finance

Comments

Post a Comment